News

Sierra Madre Increases M&I Silver-Equivalent Resources at La Guitarra by 373% to 27.2 million Ounces, Inferred Silver- Equivalent Resource Increased 204%to 20.2 million Ounces

Nov. 01, 2023 Download PDF version

VANCOUVER, BC / ACCESSWIRE / November 1, 2023 / Sierra Madre Gold and Silver Ltd. (TSXV:SM)(OTCQX:SMDRF) ("Sierra Madre" or the "Company") is pleased to announce its first project-wide Resource Estimate for the La Guitarra silver-gold mine and the Temascaltepec mining district in Estado de Mexico, Mexico. TechSer Mining Consultants Ltd. ("TechSer") of Vancouver B.C. prepared the Mineral Resource Estimate, David Thomas, P.Geo. and QP Geology and Cristian Garcia, P.Eng. and QP Mining. The following tabulates the La Guitarra estimated Mineral Resources.

Table 1: Summary La Guitarra 2023 Mineral Resource Estimate, David G. Thomas P. Geo (Effective Date: October 24, 2023)

Class | Tonnes | AgEq (g/t) | Ag (g/t) | Au (g/t) | AgEq Ozs | Ag Ozs | Au Ozs |

Indicated | 3,842,000 | 220 | 146 | 0.96 | 27,207,000 | 18,073,000 | 118,000 |

Inferred | 4,105,000 | 153 | 113 | 0.52 | 20,199,000 | 14,937,000 | 68,000 |

- See notes following Table 3

Gregory K. Liller states, "I am extremely pleased with the results of the new mineral resource estimation. This study validates our belief that La Guitarra has a significantly overlooked resource base. Since April, our staff has been working on validating the project-wide database, incorporating historical data, auditing the previously mined areas, and refining the geologic interpretation of the vein and models. The next step to re-opening the Guitarra mine will be a Mine and Restart Plan due in the first quarter of 2024; consisting of a capital and operating cost study, the results of which will be used to evaluate the economic potential of the mine."

The following tabulates the Mineral Resource Estimates by Classification and Area;

Table2: Indicated Mineral Resource Estimate

Area | Tonnes | AgEq (g/t) | Ag (g/t) | Au (g/t) | AgEq Ozs | Ag Ozs | Au Ozs |

| Nazareno | 310,000 | 257 | 215 | 0.55 | 2,564,000 | 2,141,000 | 5,000 |

| Coloso | 432,000 | 346 | 221 | 1.61 | 4,806,000 | 3,071,000 | 22,000 |

| Guitarra | 1,649,000 | 220 | 123 | 1.25 | 11,664,000 | 6,544,000 | 66,000 |

| Sub-Total | 2,391,000 | 248 | 153 | 1.22 | 19,034,000 | 11,756,000 | 93,000 |

| Los Angeles | 690,000 | 177 | 109 | 0.87 | 3,919,000 | 2,419,000 | 19,000 |

| Mina De Agua | 761,000 | 174 | 159 | 0.19 | 4,255,000 | 3,899,000 | 5,000 |

| Total Indicated | 3,842,000 | 220 | 146 | 0.96 | 27,208,000 | 18,074,000 | 117,000 |

Table 3: Inferred Mineral Resource Estimate

Area | Tonnes | AgEq (g/t) | Ag (g/t) | Au (g/t) | AgEq Ozs | Ag Ozs | Au Ozs |

| Nazareno | 754,000 | 252 | 229 | 0.29 | 6,096,000 | 5,554,000 | 7,000 |

| Coloso | 374,000 | 317 | 213 | 1.34 | 3,810,000 | 2,565,000 | 16,000 |

| Guitarra | 293,000 | 180 | 113 | 0.87 | 1,690,000 | 1,059,000 | 8,000 |

| Sub-Total | 1,421,000 | 254 | 201 | 0.68 | 11,596,000 | 9,178,000 | 31,000 |

| Los Angeles | 66,000 | 157 | 76 | 1.05 | 333,000 | 161,000 | 2,000 |

| Mina De Agua | 545,000 | 188 | 178 | 0.13 | 3,301,000 | 3,120,000 | 2,000 |

| Subtotal UG Mine | 2,032,000 | 233 | 191 | 0.55 | 15,230,000 | 12,459,000 | 35,000 |

| Inferred Tailings | 2,073,000 | 75 | 37 | 0.48 | 4,968,000 | 2,475,000 | 32,000 |

| Total Inferred | 4,105,000 | 153 | 113 | 0.52 | 20,198,000 | 14,934,000 | 67,000 |

(1) Notes for Mineral Resource Estimate:

- Canadian Institute of Mining Metallurgy and Petroleum ("CIM") definition standards were followed for the resource estimate.

- The 2023 resource models used nominal cutoff grades which are based on mining and milling costs of US$50 for cut and fill mining, US$38 per tonne for long-hole,

- A net payable recovery of 70% (historical plant recovery plus an allowance for smelter deductions, refining costs, and concentrate transportation)

- Silver price of US$22 and a gold price of $1700 and a Gold Silver Ration of 77.27:1.

- Assays were capped at 825 g/t for silver and 6.55 g/t for gold

- Variable cut-off by deposit

- Nazareno and Coloso - Block Model 135 AgEq cut-off grade (COG) and a 1 m Minimum True Thickness

- Guitarra - Polygonals Estimates 135 g/t AgEq COG and a 1 m Minimum Horizontal Width

- Los Angeles - Block Model Long Hole Mining 90 g/t AgEq COG

- Mina De Agua - East District Polygonal Estimate 135 g/t AgEq COG or 90 g/t AgEq COG and > 2 m Horizontal Width

- The tailings used a 30 g/t AgEq COG.

- Mineral Resources that are not mineral reserves do not have economic viability. Numbers may not add due to rounding.

- Numbers may not add due to rounding.

- The estimate of mineral resources may be materially affected by: metal prices and exchange rate assumptions; changes in local interpretations of mineralization geometry and continuity; changes to grade capping, density and domain assignments; changes to geotechnical, mining and metallurgical recovery assumptions; ability to maintain environmental and other regulatory permits and ability to maintain the social license to operate

- The 2023 resource estimate is prepared by David Thomas P.Geo. and Q.P. and Cristian Garcia P.Eng. and QP, of TechSer in accordance with National Instrument 43-101 Standards of Disclosure for Mineral Projects. David Thomas and Cristian Garcia are independent qualified person ("QP´s") as defined by National Instrument 43-101. A full technical report, which is being prepared in accordance with National Instrument 43-101 Standards of Disclosure for Mineral Projects, will be filed and available under the Company´s SEDAR profile at www.sedar.com within 45 days of this news release.

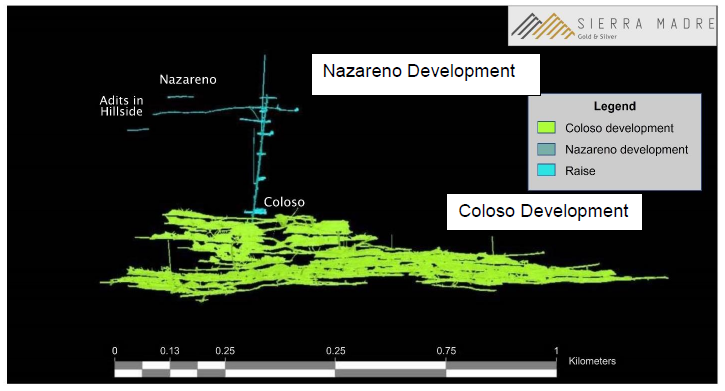

Coloso and Nazareno Development Details

The Coloso mine supplied most of La Guitarra´s production from 2015 to 2018 before being placed on care and maintenance. The Coloso and Narareno block models utilized wireframe models developed by First Majestic Silver which have been validated. The Coloso veins average width is 1.5 meters and the Nazareno veins have an average width of 4.3 meters. The Coloso mine has over 12 kilometres ("km") of existing and accessible ramps, haulage ways, cross cuts, ventilation shafts, and development drives. The Nazareno mineralization is accessed from the Coloso workings by a one km meter haulage way and was under development when the mine was closed.

Figure 1: Nazareno and Coloso Development Section

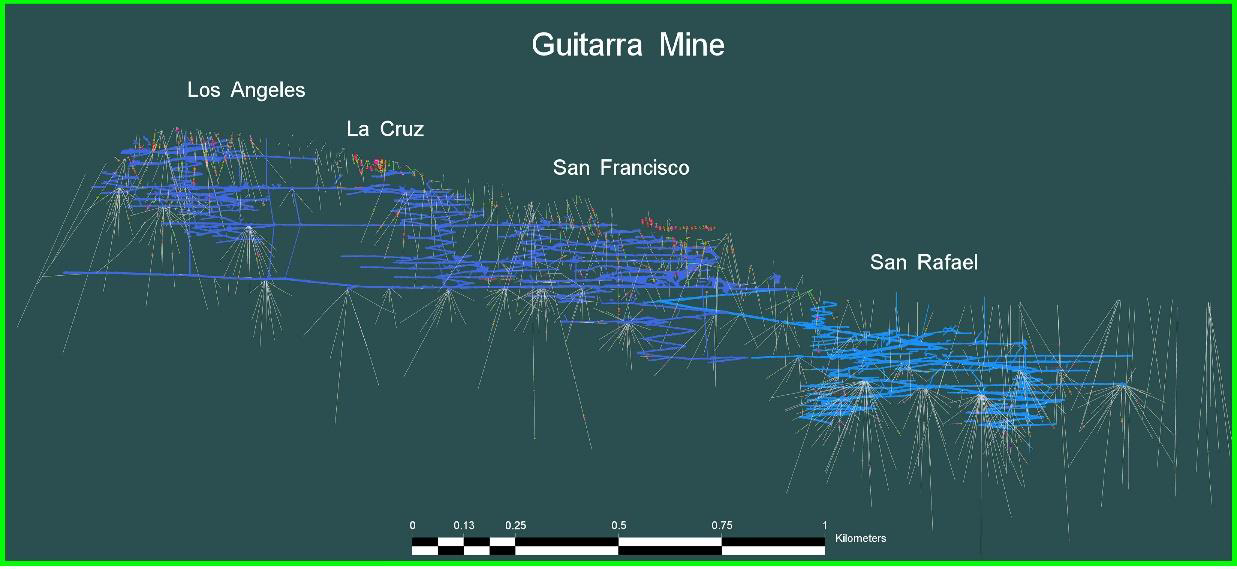

Guitarra Mine Details

The Guitarra Indicated Resources are contained in seven veins with a weighted average width (width x tonnes) for the Indicated Resources of 3.4 meters. The Guitarra mine has approximately 40 km of haulage ways, ramps, crosscuts, raises, and development drives. It is accessed from the surface at five primary levels along with several other hillside adits. A decline ramp accesses the San Rafael 1 and 2 areas and has two ventilation shafts.

Figure 2: Guitarra Mine Section

Sierra Madre management recognized that portions of the Guitarra veins and Santa Ana in the East District might be amenable to long-hole mining based on their previous mining experience at the Property and historic mining methods. The Los Angeles area in the Guitarra mine was found to have vein and stockwork mineralization in a configuration that could be amenable to long-hole mining methods. The Los Angeles mineralization is accessible on three haulage way levels, several ramps, and multiple development drives. Existing ore passes on the La Cruz, Los Angeles, San Francisco, and Garambullo levels connect to the San Rafael haulage way, the primary haulage way to the Guitarra flotation plant.

Figure 3: Los Angeles Section

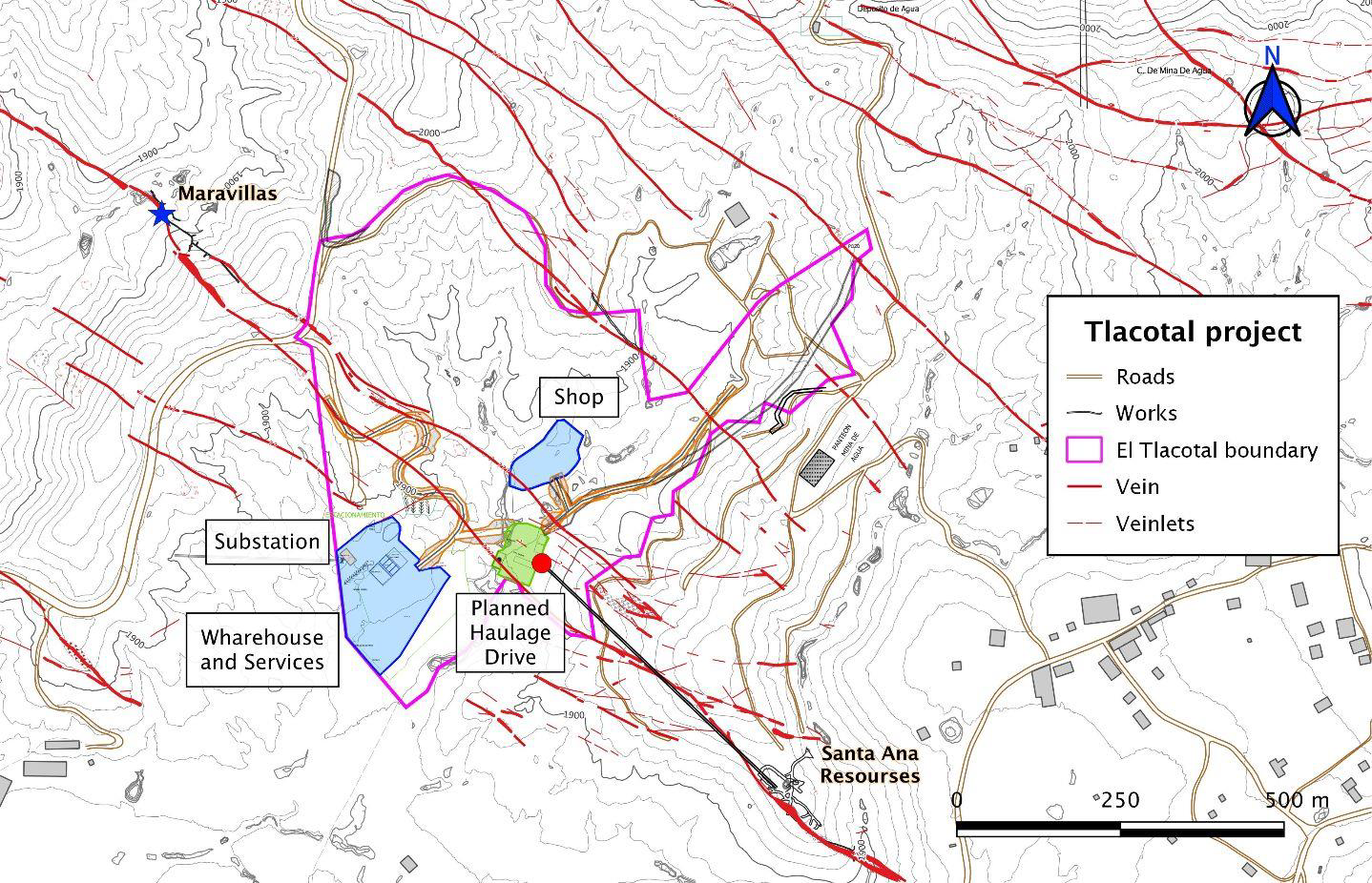

Tlacotal Project

The Santa Ana vein (also known as Mina de Agua shown in Table 2 and Table 3) in the East District has an average width of 7.1 meters. First Majestic completed an approved Environmental Impact Statement (MIA) to develop Santa Ana. The operating area is called La Tlacotal, and the Company has a long-term land use agreement on the surface.

Figure 4: Tlacotal Project Details

Sierra Madre will participate in a webinar at 2pm ET on Thursday November 2nd to discuss the updated resource. Participants can register here: https://us02web.zoom.us/webinar/register/WN_P5yt6om8SH-DbU22oAgppA.

The session will also be live streamed and a replay will be posted on the Adelaide Capital YouTube Channel here: https://www.youtube.com/channel/UC7Jpt_DWjF1qSCzfKlpLMWw.

Qualified Person

Mr. Gregory Smith, P. Geo, Director of Sierra Madre, is a Qualified Person as defined by NI 43-101, and has reviewed and approved the technical data and information contained in this news release. Mr. Smith has verified the technical and scientific data disclosed herein.

About Sierra Madre

Sierra Madre Gold & Silver (TSX.V:SM)(OTCQX:SMDRF) is a precious metals development and exploration company, focused on evaluating the potential of restarting the La Guitarra Mine in the Temascaltepec mining district, Mexico, and the exploration and development of its Tepic and La Tigra properties in Nayarit, Mexico. The La Guitarra Mine is a permitted, past-producing underground mine which includes a 500 t/d processing facility that operated until mid-2018.

The +2,600 ha Tepic Project hosts low-sulphidation epithermal gold and silver mineralization with an existing historic resource. La Tigra, located 148 km north of Tepic, has been mined historically; Sierra Madre´s maiden 2022 drill program at the site intercepted shallow mineralization.

Sierra Madre´s management has played key roles for managing exploration and development of more than 22Moz gold and 600Moz silver in combined reserves and resources. Sierra Madre´s team of professionals has collectively raised over $1B for mining companies.

On behalf of the board of directors of Sierra Madre Gold and Silver Ltd.,

"Alexander Langer"

Alexander Langer

President, Chief Executive Officer and Director

+1 (604) 765-1604

Contact:

investor@sierramadregoldandsilver.com

Cautionary Note

Neither the TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in the policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this news release.

This press release contains "forward-looking information" and "forward-looking statements" within the meaning of applicable securities legislation. The forward-looking statements herein are made as of the date of this press release only, and the Company does not assume any obligation to update or revise them to reflect new information, estimates or opinions, future events or results or otherwise, except as required by applicable law. Often, but not always, forward-looking statements can be identified by the use of words such as "plans", "expects", "is expected", "budgets", "scheduled", "estimates", "forecasts", "predicts", "projects", "intends", "targets", "aims", "anticipates" or "believes" or variations (including negative variations) of such words and phrases or may be identified by statements to the effect that certain actions "may", "could", "should", "would", "might" or "will" be taken, occur or be achieved. Forward-looking information in this press release includes, but is not limited to, statements with respect to the completion of the Transaction on the terms set out in the definitive agreement (or at all) and the ability of the Company to obtain requisite corporate and regulatory approvals for the Transaction, including but not limited to the approval of the Exchange, Mexican antitrust approval and other governmental approvals as currently anticipated.

In making the forward-looking statements included in this news release, the Company has applied several material assumptions, including that the Company will be able to receive all required regulatory approvals by the timelines currently anticipated (or at all); and that the Company will be able to complete the Transaction on the terms of the definitive agreement. Forward-looking statements and information are subject to various known and unknown risks and uncertainties, many of which are beyond the ability of the Company to control or predict, that may cause the Company´s actual results, performance or achievements to be materially different from those expressed or implied thereby, and are developed based on assumptions about such risks, uncertainties and other factors set out herein, including, but not limited to, the risk that the Company is not able to complete Transaction on the terms set out in the definitive agreement (or at all) and the risk that the Company is unable to obtain requisite corporate and regulatory approvals, including but not limited to the approval of the TSX Venture Exchange, the Mexican antitrust approval and governmental approval as currently anticipated.

Such forward-looking information represents management´s best judgment based on information currently available. No forward-looking statement can be guaranteed and actual future results may vary materially. Accordingly, readers are advised not to place undue reliance on forward-looking statements or information.

SOURCE: Sierra Madre Gold and Silver

View source version on accesswire.com:

https://www.accesswire.com/798250/sierra-madre-increases-mi-silver-equivalent-resources-at-la-guitarra-by-373-to-272-million-ounces-inferred-silver-equivalent-resource-increased-204to-202-million-ounces